Complex Shapes, Simple Solution

White Papers

For production runs of tough-to-machine small parts, cold forming looks better than ever.

Producers of cold-drawn and cold-rolled shapes have long extolled the many virtues of their manufacturing processes — often to an unacquainted U.S. OEM market. Even though precision cold-formed shapes typically boast better finishes, tighter tolerances and more consistent dimensional repeatability than their machined counterparts, the vast majority of metal parts purchased in the United States continue to be machined or cast.

But the ever-more competitive global economy has added another powerful weapon to the marketing arsenal of precision cold-formers: cost efficiency. As OEMs apply increasing pressure on a shrinking pool of domestic make-to-order precision parts makers, cold forming has emerged as an extremely cost-effective production method in many applications.

Simply put, for relatively small, complex production components, it’s tough to beat the quality-to-price ratio of cold drawing and cold rolling.

Whether for mature markets like the automotive or firearms business, or in emerging markets such as optical electronics, designers and engineers are demanding more than ever before from critical components. Shapes are more complex and expected turnaround times for manufacturing and delivery, even on relatively small production runs, are shorter.

It is a common misconception that cold forming is more expensive and time-consuming than machining. But for difficult, precise shapes in quantity, the opposite is often true.

Cold, Hard Facts

Like the more widely understood machining process, the basic principles of cold forming haven’t changed much since the Industrial Revolution. Of course, the process has been refined significantly over the years to meet the demands of modern OEMs.

Cold rolling introduces bar or coil stock between a series of pre-shaped rollers, which compress and spread the material, enhancing its mechanical properties. Cold rolling imparts better surface finishes than drawing and is better suited for simpler profiles with less demanding tolerances.

The cold drawing process uses extreme pressure to pull room-temperature raw material ¾ ranging from copper, brass, carbon, alloy and stainless steels ¾ into a controlled series of progressive dies. The process gradually and consistently establishes the contours of the specified part while simultaneously cold-working the material, increasing tensile strength and hardness.

A skillfully crafted progression of carbide dies can be used to create complex shapes with consistent corners/fillets, outside radii to ± .005″ and even dovetail and undercut profile configurations. These finished shaped profiles are provided to the customer as cut-to-length parts, straight lengths or coils.

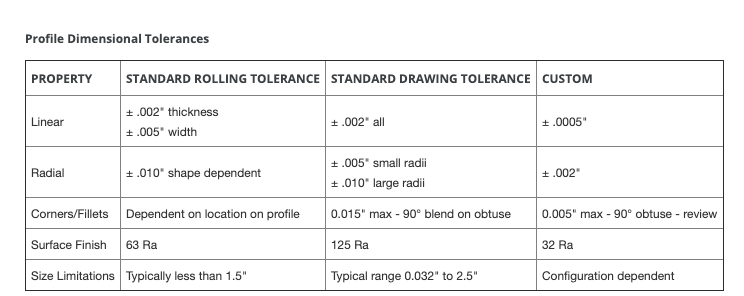

Cold drawing often gets confused with hot extrusion, which entails pushing hot billet material through an extrusion die. Hot extruded profiles are typically used for larger profiles up to 6″ that do not require increased mechanical properties or the closer linear, radial and surface finish tolerances offered by cold drawing. Linear tolerances of ± .020″ and radial tolerances of ± .062″ combined with surface finishes up to 250 Ra are typical for steel and stainless hot extrusions. Meanwhile, cold drawn profiles routinely feature linear tolerances of ± .002″, radial tolerances of ± .005″ and surface finishes 63 Ra or better. Accordingly, they require little or no finish machining, grinding or polishing before use. It’s that "near net shape" capability that has attracted manufacturers of a wide range of products, from turbines to telecommunication devices, to cold drawing.

Although production machining methods, including wire electrical discharge machining, laser- and water-jet cutting, and multi-axis computer numeric controlled (CNC) machining are capable of generating very complex metal parts, those technologies can be more expensive and require more programming and production time than cold forming. In addition, they may not be cost-effective for intermediate to long run jobs.

And in an era where skilled machinists are in short supply for production machine shops, using a cold formed starting profile can provide much needed assistance by eliminating all outside profile machining. The cold drawn shape could also assist time-constrained machine shops by providing a consistent datum reference surface in the event additional machining may be required. In fact, the tolerances and part repeatability that can be obtained by sophisticated cold forming operations can be out of the reach of many traditional machine shops.

Well-equipped and experienced cold drawing shops can hold up to +/- .0005″ on linear tolerances, and +/- .002″ on radial tolerances. Size limitations are dependent on the configuration of the part, but components typically measure less than 1.500″ in diameter if cold rolled, and from .032″ to 2.500″ in diameter if cold drawn.

Naturally, that comparatively small work envelope is also the biggest limiter of cold-forming’s applicability. Usually, it is neither cost-effective nor practical to draw stock much larger than that 2.500″ upper limit, where casting, hot extrusions and machining are better suited.

Given the right dimensions, though, cold forming has another big advantage over machining, especially in the penny-pinching world of production components: since there’s no cutting or grinding in the process, there’s no wasted raw material. This "chip-less fabrication" feature is an immediate, bottom-line benefit for OEMs whose components are being machined from costly alloys.

Art and Science

The majority of cold forming manufacturers produce profiles on a make-to-order basis. In some instances, cold formers may also establish both JIT and stocking programs to assist their repeat customers. These stocking programs may be either for the finish profile or initial raw material. Blanket orders with scheduled release dates are yet another tool routinely used by the customer and cold former to minimize turnaround time.

It’s a business that has truly evolved with the times and technology, a characterization also reflected in the "front end" of modern cold-forming shops which— like their machine shop brethren — utilize the latest computer file transfer utilities to accept and quickly issue quotations on customers’ drawings.

In addition to the traditional hard copy prints, today’s cold-forming operations usually have the ability to receive and transmit drawings in most popular electronic formats and CAD software. E-mail is an increasingly common method of communication with customers.

The world of cold forming is still, however, a very traditional, service-oriented business, another trait it shares with the machining industry. Customers— especially those new to cold forming— usually require personal attention for their projects. Accounts trying their first precision cold-drawn or cold-rolled part order will be familiar with the make-to-order ritual of inquiry-quotation-order, although the manufacturing process may seem foreign. Pre-production samples are almost invariably provided to customers for inspection, a comparatively rare practice with contract machining suppliers. These cold worked samples, using the same tooling and processing as the production material, provide the customer with a good representation of future production quality. Additionally, most responsive cold forming manufacturers are also willing to supply limited sample material for purposes of assisting machine shops with their initial fixture/tooling setup and PPAP requirements.

The economic barriers to entry to the cold forming business are high enough to prevent a proliferation of suppliers. Capital equipment such as powerful drawing benches, rolling mills, high production cut-off saws, and tooling manufacture and inspection equipment are expensive.

Specialized equipment is only one facet of the cold forming trade. The most important asset is personnel experience. Some cold forming manufacturers may have up to 100 years experience in this endeavor. This experience in tooling manufacture and process design is central to quality cold forming. In fact, industry veterans often suggest there’s an element of art in what is essentially a metalworking science practiced by cold formers. Their experience in the process capabilities of cold-forming — the metallurgical reactions of various alloys to high pressure, coupled with the most efficient methods for achieving specified tolerances — can make the difference between high-performance parts and parts that don’t measure up.

That means "measure," literally: cold-drawn and cold-rolled parts are governed by the same manufacturing standards as any other fabricated component. The major difference in the quality of a finished cold-formed part is almost exclusively a function of the quality of the progressive tooling used, whereas machined parts are largely a reflection of the machinist at the controls of the CNC, electrical discharge, laser or water jet machine that made it.

Weighing the Choices

Customer-specific tooling — specifically the progressive carbide dies crafted by cold-forming houses — is certainly the most significant upfront cost in a new order. This one time process development expense is dependent on part complexity and size but can run between $300 to $6,000. Process development time including tooling manufacture will also vary depending on profile complexity, mill workload, and raw material. This shape-dependent development time may be from 3 weeks to 18 weeks before a sample part can be presented to a customer for approval. Because the process development and tooling are inherently shape dependent, it is recommended that these issues be discussed in detail with your potential cold former.

Those weighing the pros and cons of cold drawing and cold forming need to consider all the factors before choosing either for a given precision shape. Production volume is near the top of that list of considerations, since the processes up-front costs and turnaround time do not normally lend themselves to prototype or one time small quantity runs.

Depending on the turnaround time required, material availability might be another issue that has to be examined prior to selecting a cold-forming process. Forming houses will usually stock a fair number of common grades and sizes, but for certain highly engineered parts the lead-time may be at the mercy of the steel mill producing the raw material. Lead-time variability may also relate to raw material availability in bar or coil form since it is usually more efficient for a cold drawer to internally process coil raw material than to process the same shape from bar raw stock. In any event, the best option is to discuss your profile, material and delivery requirements with the cold forming manufacturer so all your options can be considered.

Components that are ordered repeatedly are ideal candidates for cold drawing. These components are usually processed through long wearing carbide dies that are maintained and replaced at the cold drawers’ expense. Cold drawn profiles aren’t subject to the faster tool wear, machine temperature variations, and operator experience variability that can create lot-to-lot, or even part-to-part, discrepancies. Minimizing these potential machining-related discrepancies can result in the elimination of costly rejections or part quarantines at customer sites.

Precision components requiring minimal finish drilling, milling or polishing are also logical prospects for cold forming, particularly if the component specifications call for predictable dimensional uniformity.

Industry suppliers anticipate the popularity of cold-forming will continue to grow right along with OEMs’ demands for on-time, in tolerance, below-budget precision parts. There’s no greater equalizer than the relentlessly efficient world economy, and quality-conscious European manufacturers have already embraced cold drawing and rolling as the processes of choice for small, complex shapes — a reliable alternative for domestic OEMs who need to keep up with their global competitors.

***

By Glenn W. Eberly

Carpenter Technology Corporation